Context

For ensuring sustainable social and economic development, it is essential to generate adequate domestic resources. This is particularly true for a state like Nepal, which has endured a serious economic fall-out from the covid pandemic. Nepal has therefore developed a roadmap to improve domestic resource mobilisation capacity, focusing on both tax and non-tax revenue sources. Through thisa mix of policy and administrative measures, Nepal aims to increase its revenuetax to GDP ratio to 30 percent of gross domestic product (GDP) by 2030. The timing of these reforms gain further significance in view of Nepal’s planned graduation from the Least Developed Country (LDC) status in 2026.

Objective

Nepal’s tax system is modernized to align with the country’s long-term objective of being a financially stable and investment friendly country.

Approach

To contribute to Nepal’s objectives, the RAS project is designed to strengthen the tax administration in Nepal.

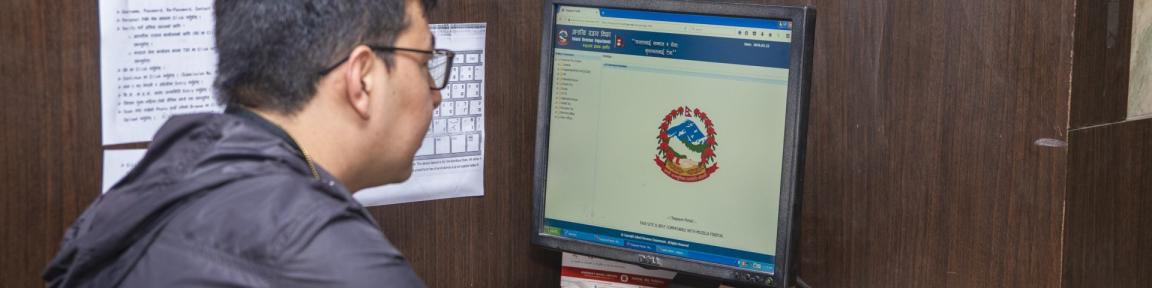

RAS capacitates the Inland Revenue Department (IRD) through digital tools and enhanced audit skills. Thereby the project improves the efficiency as well as equitability of the tax system, and contributes to enhancing voluntary tax compliance by facilitating and raising awareness among taxpayers.

The project cooperates with actors at central and subnational level and provides advisory services to the revenue authorities in three areas:

- Strengthening of IT systems at the federal tax authority to improve compliance with taxpayer’s obligations

- Enhancing the audit capacity of the tax authority and introduction of new tools and methodologies

- Improving taxpayer services to reduce compliance costs

The project's cooperation with the IRD of Nepal is key, as it collects close to half of government tax revenues in Nepal.

Last update: May 2024